🔐 USDT Mixer — Total Privacy for Your Crypto

Experience fast and secure USDT TRC20 mixing. 🌀

No accounts. No records. Just full anonymity, 24/7. ✅

Service fees start at only 0.5%.

- Mastering 5-Minute XRP Spot Trading on Binance: Your Ultimate Setup Guide

- Why Trade XRP on Binance?

- Understanding the 5-Minute Timeframe Dynamics

- Best Settings for 5-Minute XRP Spot Trading on Binance

- Chart Setup & Indicators

- Order Execution Tactics

- Risk Management Protocol

- Step-by-Step 5-Minute Trading Strategy

- Critical Mistakes to Avoid

- FAQ: 5-Minute XRP Trading on Binance

Mastering 5-Minute XRP Spot Trading on Binance: Your Ultimate Setup Guide

Spot trading XRP on Binance using a 5-minute timeframe offers explosive opportunities for agile traders. This high-intensity approach capitalizes on XRP’s volatility while leveraging Binance’s low fees and deep liquidity. Unlike longer timeframes, the 5-minute chart demands precision settings and razor-sharp execution. In this guide, you’ll discover battle-tested configurations for indicators, risk parameters, and order types specifically optimized for XRP’s unique price action. Whether scalping micro-trends or riding momentum waves, these settings transform raw market data into actionable signals – turning the 5-minute chaos into calculated profit opportunities.

Why Trade XRP on Binance?

Binance dominates as the premier platform for XRP spot trading thanks to:

- Unmatched Liquidity: Tighter spreads and minimal slippage during volatile moves

- 0.1% Spot Trading Fees: Lowest industry rates preserve profit margins

- Advanced Charting Tools: 100+ indicators and drawing tools for technical analysis

- Real-Time Order Execution: Market, limit, and stop-limit orders execute in milliseconds

- Regulatory Compliance: Secure trading despite XRP’s legal landscape

Understanding the 5-Minute Timeframe Dynamics

The 5-minute chart compresses market psychology into rapid-fire candlesticks. For XRP – known for 5-10% intraday swings – this timeframe reveals:

- Micro-Trend Identification: Catch emerging bull/bear flags before higher timeframes react

- News Reaction Scalping: Capitalize on SEC updates or partnership announcements instantly

- Reduced Noise: Filters out irrelevant hourly fluctuations while maintaining signal clarity

Warning: This strategy requires constant screen attention – ideal for dedicated day traders, not passive investors.

Best Settings for 5-Minute XRP Spot Trading on Binance

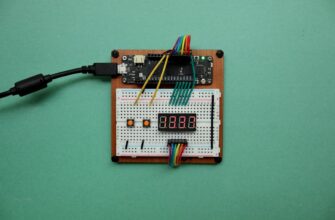

Chart Setup & Indicators

- EMA Ribbon: 8, 21, 50-period Exponential Moving Averages (identify trend direction)

- RSI (14-period): Overbought (70+) and oversold (30-) zones for reversals

- Volume Profile: Detect high-volume support/resistance levels

- Bollinger Bands (20,2): Spot volatility contractions before breakouts

Pro Tip: Set chart theme to dark mode to reduce eye strain during extended sessions.

Order Execution Tactics

- Limit Orders: Enter at key support/resistance levels for optimal pricing

- Stop-Limit Orders: Auto-sell at -2% from entry to cap losses

- Take-Profit Targets: Scale out at +1.5%, +3%, and +5% levels

Risk Management Protocol

- Never risk >1% of capital per trade

- Minimum position size: 500 XRP (avoids fee erosion)

- Stop-loss MUST be set before every entry

- Daily loss limit: 5% account balance

Step-by-Step 5-Minute Trading Strategy

- Confirm overall trend using 1-hour chart (bullish/bearish)

- Wait for EMA ribbon alignment on 5-min chart (e.g., 8EMA > 21EMA > 50EMA)

- Enter when RSI crosses 30 (bullish) or 70 (bearish) with volume spike

- Set stop-loss below nearest swing low (bullish) or above swing high (bearish)

- Take 50% profit at 1.5% gain, move stop to breakeven

- Trail remainder with 21EMA as dynamic exit

Critical Mistakes to Avoid

- Overtrading: Max 3-5 trades/day to avoid emotional decisions

- Ignoring Bitcoin Correlation: XRP follows BTC 70%+ of the time – check BTC 5-min chart

- Chasing Pumps: Enter only at confirmed support, not FOMO peaks

- Neglecting Fees: Factor in 0.1% taker fee for profit calculations

FAQ: 5-Minute XRP Trading on Binance

Q: Can I automate this 5-minute strategy?

A: Binance doesn’t allow full automation for spot trading. Use price alerts for entries but manual execution is required.

Q: What’s the ideal capital for this approach?

A: Minimum $500 to withstand volatility while maintaining position sizing rules.

Q: How many indicators are too many?

A: Stick to 3-4 core tools. Overloading charts causes analysis paralysis on fast timeframes.

Q: Should I trade during specific hours?

A: Focus on overlap of US/EU sessions (13:00-17:00 UTC) for peak liquidity and volatility.

Q: How do I handle XRP-specific news events?

A: Pause trading 15 mins pre-announcement. Resume only when volatility stabilizes post-spike.

Mastering XRP spot trading on Binance’s 5-minute chart demands discipline, but the profit potential is immense. By combining these technical settings with iron-clad risk management, you’ll transform rapid price movements into consistent gains. Remember: In high-speed trading, your preparation determines your profits.

🔐 USDT Mixer — Total Privacy for Your Crypto

Experience fast and secure USDT TRC20 mixing. 🌀

No accounts. No records. Just full anonymity, 24/7. ✅

Service fees start at only 0.5%.