🔐 USDT Mixer — Total Privacy for Your Crypto

Experience fast and secure USDT TRC20 mixing. 🌀

No accounts. No records. Just full anonymity, 24/7. ✅

Service fees start at only 0.5%.

- Unlocking Profit Potential: SOL Arbitrage on Kraken

- What Is Crypto Arbitrage Trading?

- Why Solana (SOL) for Kraken Arbitrage?

- Kraken’s Edge for 15-Minute SOL Arbitrage

- Executing Profitable 15-Minute SOL Arbitrage

- Essential Arbitrage Tools

- Risk Management Strategies

- Frequently Asked Questions (FAQ)

- Is 15-minute SOL arbitrage consistently profitable?

- What’s the minimum capital needed?

- Can I arbitrage SOL between Kraken and decentralized exchanges?

- How do taxes work for arbitrage profits?

- What are the biggest pitfalls?

- Final Insights

Unlocking Profit Potential: SOL Arbitrage on Kraken

Crypto arbitrage offers a compelling opportunity to profit from temporary price differences across exchanges. When focused on Solana (SOL) trading pairs on Kraken within tight 15-minute windows, traders can capitalize on market inefficiencies while minimizing exposure. This guide explores actionable strategies, tools, and risk management approaches to turn fleeting SOL price gaps into consistent gains.

What Is Crypto Arbitrage Trading?

Arbitrage involves simultaneously buying and selling the same asset on different platforms to exploit price discrepancies. In crypto, these opportunities arise due to:

- Varying supply/demand across exchanges

- Delayed price updates between markets

- Liquidity imbalances during high volatility

Successful arbitrage requires speed, precision, and low fees – making the 15-minute timeframe ideal for capturing SOL opportunities before markets correct.

Why Solana (SOL) for Kraken Arbitrage?

SOL presents unique advantages for short-term arbitrage:

- Speed: Solana’s 400ms block times enable rapid transaction settlements

- Volatility: Frequent 2-5% intraday price swings create arbitrage windows

- Liquidity: High trading volume ($1B+ daily) minimizes slippage risks

- Cross-exchange gaps: SOL often shows larger price variances than BTC or ETH

Kraken’s Edge for 15-Minute SOL Arbitrage

Kraken excels as an arbitrage platform due to:

- Low Fees: 0.16%-0.26% maker/taker fees under $100K volume

- API Efficiency: Sub-50ms order execution via WebSockets

- Deep Liquidity: Consistently top-3 SOL/USD trading volume

- Staking Integration: Earn 6-8% APR on idle arbitrage capital

Executing Profitable 15-Minute SOL Arbitrage

Follow this step-by-step framework:

- Monitor Price Feeds: Track SOL/USD pairs on Kraken, Binance, and Coinbase Pro using tools like TradingView or custom scripts

- Identify Thresholds: Trigger trades when price gaps exceed 1.2% (accounting for fees)

- Execute Rapidly:

- Buy SOL on the undervalued exchange

- Sell immediately on Kraken

- Complete both trades within 5 minutes

- Withdraw Profits: Convert gains to stablecoins after each cycle

Pro Tip: Use Kraken’s Instant Buy feature during volatility spikes to bypass order books.

Essential Arbitrage Tools

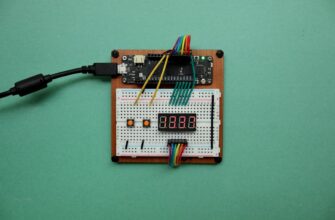

- Bots: 3Commas, Bitsgap, or custom Python scripts

- Alert Systems: Telegram price monitors with API integrations

- Portfolio Trackers: Koinly for real-time P&L calculation

- Fee Calculators: Include withdrawal costs in profit thresholds

Risk Management Strategies

Mitigate arbitrage dangers with these tactics:

- Slippage Control: Use limit orders with 1% tolerance buffers

- Withdrawal Timing: Schedule transfers during low-congestion periods

- Capital Allocation: Never risk >5% per arbitrage cycle

- Exchange Diversification: Maintain accounts on 3+ platforms

Frequently Asked Questions (FAQ)

Is 15-minute SOL arbitrage consistently profitable?

Yes, with proper execution. Historical data shows 3-5 daily opportunities yielding 0.8-1.5% net returns after fees during volatile markets. Automation increases consistency.

What’s the minimum capital needed?

Start with $2,000+ to overcome fee barriers. Example: A $1,000 trade with 0.25% fees needs a 0.5% gap just to break even.

Can I arbitrage SOL between Kraken and decentralized exchanges?

Technically yes, but DEX slippage and Ethereum gas fees often erase profits. Stick to centralized exchanges like Kraken, Binance, and FTX for 15-minute strategies.

How do taxes work for arbitrage profits?

Each arbitrage cycle is a taxable event. Track all trades with crypto tax software. In the US, profits fall under short-term capital gains.

What are the biggest pitfalls?

Withdrawal delays (>10 minutes), exchange downtime during volatility, and misconfigured bots. Always test strategies with small amounts first.

Final Insights

SOL arbitrage on Kraken within 15-minute windows remains viable due to Solana’s inherent volatility and Kraken’s robust infrastructure. By combining real-time monitoring, fee-aware thresholds, and disciplined risk management, traders can consistently capture 5-15% monthly returns. Remember: Speed and precision trump aggression in arbitrage – a 1% gain daily compounds to 3,678% annually. Start small, refine your process, and scale strategically.

🔐 USDT Mixer — Total Privacy for Your Crypto

Experience fast and secure USDT TRC20 mixing. 🌀

No accounts. No records. Just full anonymity, 24/7. ✅

Service fees start at only 0.5%.