🔐 USDT Mixer — Total Privacy for Your Crypto

Experience fast and secure USDT TRC20 mixing. 🌀

No accounts. No records. Just full anonymity, 24/7. ✅

Service fees start at only 0.5%.

- Introduction to PEPE Coin Futures Trading on Kraken

- Why Trade PEPE Coin Futures on Kraken?

- Understanding Weekly Timeframe Analysis

- Step-by-Step: Trading PEPE Futures on Kraken (Weekly Strategy)

- Step 1: Account Setup & Funding

- Step 2: Access Futures Dashboard

- Step 3: Analyze Weekly Charts

- Step 4: Execute Your Trade

- Step 5: Weekly Position Management

- Risk Management Essentials

- Weekly vs. Daily Trading: Key Differences

- FAQ: PEPE Futures on Kraken (Weekly Timeframe)

- Conclusion: Mastering PEPE’s Macro Moves

Introduction to PEPE Coin Futures Trading on Kraken

PEPE Coin, the viral meme cryptocurrency inspired by internet culture, has exploded in popularity—and volatility. For traders seeking to capitalize on its dramatic price swings without holding the asset directly, futures trading on Kraken offers a powerful solution. This comprehensive guide walks you through futures trading PEPE Coin on Kraken using weekly timeframes—a strategic approach that filters market noise and aligns with broader trend movements. Whether you’re a swing trader or position holder, mastering weekly charts could transform your crypto strategy.

Why Trade PEPE Coin Futures on Kraken?

Kraken stands out for PEPE futures trading due to:

- High Liquidity: Deep order books ensure smooth entry/exit for PEPE/USD pairs

- Advanced Charting: Built-in TradingView tools for multi-timeframe analysis

- Leverage Options: Up to 50x on crypto perpetual futures (use cautiously!)

- Security: Industry-leading cold storage and regulatory compliance

- Perpetual Contracts: Trade PEPE without expiration dates

Understanding Weekly Timeframe Analysis

Weekly charts compress price action into 7-day candles, revealing macro trends invisible on shorter timeframes. Benefits include:

- Reduced market noise from intraday volatility

- Clear identification of support/resistance zones

- Alignment with fundamental catalysts (e.g., exchange listings)

- Compatibility with swing trading strategies

- Lower emotional stress versus day trading

Step-by-Step: Trading PEPE Futures on Kraken (Weekly Strategy)

Step 1: Account Setup & Funding

- Sign up at Kraken.com and complete KYC verification

- Enable Two-Factor Authentication (2FA) for security

- Deposit USD via wire transfer or crypto (BTC/ETH)

Step 2: Access Futures Dashboard

- Navigate to ‘Trade’ → ‘Futures’ on Kraken’s top menu

- Search for “PEPE” in the markets selector

- Select “PEPE/USD Perpetual” contract

Step 3: Analyze Weekly Charts

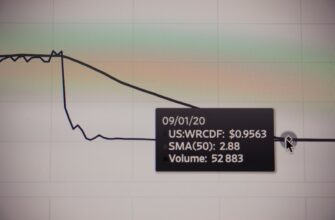

- Switch chart timeframe to “1W” (weekly)

- Add indicators: 20 & 50 EMA (trend direction), RSI (overbought/oversold)

- Identify key support/resistance from historical price clusters

Step 4: Execute Your Trade

- Choose position: LONG (betting on rise) or SHORT (betting on fall)

- Set leverage (start low: 5-10x for weekly trades)

- Use limit orders near support/resistance levels

- Place stop-loss 15-20% below entry (adjust for volatility)

Step 5: Weekly Position Management

- Monitor Sunday candle closes for trend confirmation

- Adjust stop-loss to breakeven when 30% profit target hit

- Re-evaluate fundamentals bi-weekly (e.g., PEPE ecosystem updates)

Risk Management Essentials

PEPE’s extreme volatility demands disciplined risk controls:

- Never risk >2% of capital on one trade

- Use Kraken’s “Reduce-Only” orders to prevent over-leverage

- Diversify—don’t allocate >20% portfolio to meme coins

- Set price alerts for key weekly levels

Weekly vs. Daily Trading: Key Differences

| Factor | Weekly Timeframe | Daily Timeframe |

|---|---|---|

| Trade Duration | Weeks to months | Days to weeks |

| Chart Noise | Low | Moderate |

| Ideal For | Swing traders, position holders | Active traders |

| Stop-Loss Size | Wider (15-25%) | Tighter (5-10%) |

FAQ: PEPE Futures on Kraken (Weekly Timeframe)

Q: What leverage is available for PEPE futures on Kraken?

A: Kraken offers up to 50x leverage, but 5-10x is recommended for weekly strategies to withstand volatility.

Q: Can U.S. traders access PEPE futures on Kraken?

A: No. Kraken Futures isn’t available to U.S. residents due to regulations. Use VPN alternatives at your own risk.

Q: How much capital do I need to start?

A> Minimum $50, but $500+ allows better position sizing for weekly stops. PEPE trades in 1-contract increments (~$0.000001 per contract).

Q: Which indicators work best on weekly PEPE charts?

A> EMA crossovers (20/50), RSI divergences, and volume spikes at key levels offer high-probability signals.

Q: How do funding rates affect weekly positions?

A> PEPE’s funding rate (paid every 8 hours) can erode profits. Check rates before entering and monitor bi-weekly.

Conclusion: Mastering PEPE’s Macro Moves

Trading PEPE Coin futures on Kraken using weekly timeframes transforms meme coin volatility into strategic opportunity. By focusing on macro trends, implementing strict risk management, and leveraging Kraken’s robust platform, traders can navigate PEPE’s wild price action with confidence. Remember: Weekly strategies require patience—wait for Sunday candle closes before making decisions. Start small, document every trade, and never risk capital you can’t afford to lose in this high-stakes arena.

🔐 USDT Mixer — Total Privacy for Your Crypto

Experience fast and secure USDT TRC20 mixing. 🌀

No accounts. No records. Just full anonymity, 24/7. ✅

Service fees start at only 0.5%.